Children's services are reporting financial crises with 75% of authorities having current year budget overspends and the Local Government Association predicting a £2bn funding gap by 2020.

In the residential care sector, judges criticised the lack of appropriate specialist provision in high-profile court cases last year. Government statistics show demand for children's homes placements increasing and indications from Ofsted are that supply is not keeping pace.

Providers are experiencing unprecedented numbers of referrals, although many children referred are not an appropriate match to the services offered. The scramble for available places is likely to compromise planning and matching a home to best meet a child's needs.

Costs and prices are escalating but previous ministers have resisted calls for increased funding until authorities can show current funds are well spent.

A large majority of placement activity currently takes the form of spot placement at time of need. This is the case even under established regional consortia frameworks. Surveys have shown that the frameworks have limited success in containing prices and that the underlying market forces result in framework processes being regularly overridden. The economic implications of a predominantly spot-purchased marketplace plainly include built in inefficiency and risk.

It is therefore timely to reflect on the potential of alternative forms of commissioning and to remind authorities of the economic and practice benefits of alternatives to spot purchasing (see tables).

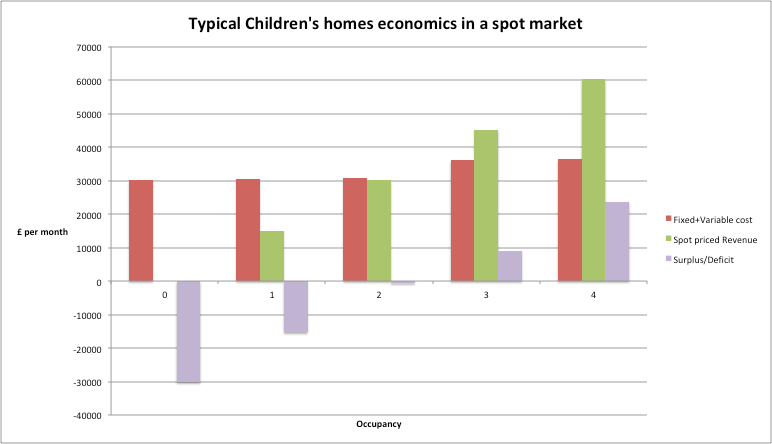

Table 1: The ‘spot' market

- The provider prices its services so as to target a break-even trading result at a little over 50% occupancy and takes all of the upfront investment risk and risk associated with periods of occupancy below 50% when the business cannot easily shed costs and therefore incurs a deficit or loss.

- With higher occupancy, the provider makes a surplus and at full occupancy, maximises profits relative to fee income (here over 30% net margin).

- Given market conditions and competitive pressures, to compensate for occupancy and volatility of demand risk, the provider is drawn to set the highest price.

- With high demand, short supply and an ability to add to prices, the providers potentially accelerate higher returns.

- Where purchasers limit prices providers can quickly slip to unsustainable loss-making.

- The model is inherently volatile.

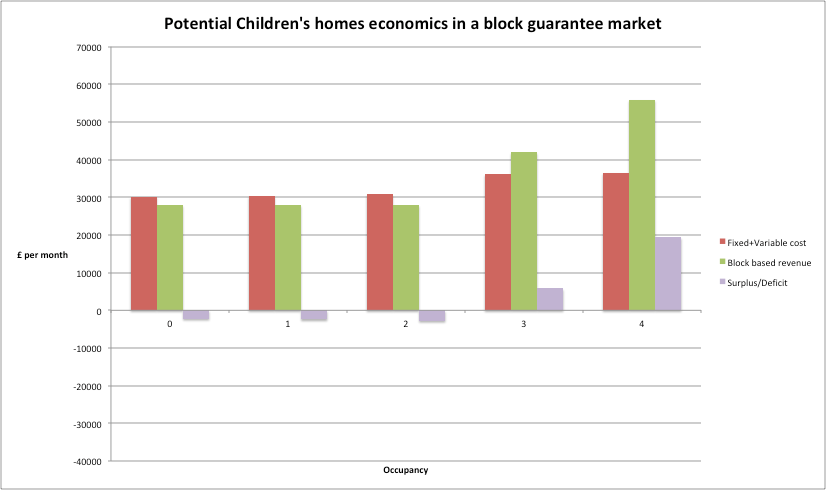

Table 2: Alternative block guarantee

Here the authority guarantees buying at least two places at the home:

- The price is 7% lower than the ‘spot' price so the authority gets an immediate and measurable saving.

- Providers offer lower price in exchange for elimination of low occupancy risk through a more sustainable partnership.

- The outcome at higher occupancy levels is not as profitable for the provider as the spot model but the long-term business stability and relationships for children and staff are of greater value and likely to encourage further investment and innovation.

The block model moves significant demand risk to the purchaser. Good data about previous and projected trends in need would enable a purchaser to confidently enter into block commitments that are safely below the minimum level of aggregate needs.

Pragmatic arrangements will include regular reviews of purchasing and placement patterns with variation provisions allowing for agreed methods of manageably increasing or reducing the block to ensure that the arrangements remain appropriate to match need.

Appropriate commissioning and procurement procedures with flexibility and adaptation of the relationship during the contracted period are the ethics and practice that create trust-based working relationships and structures.

This is a ‘win-win-win' situation:

- Children are placed into a more sustainable and stable environment where the corporate parents, the authority and provider work within a procurement and parenting model to deliver the right care at the right time at the right price.

- The authority gets more stable placements at a lower price.

- The provider can evidence a more stable pattern of trading, underpinned by contracts that add overall value to the business. The current spot based model fails on every level:

- There are adversarial relationships and an unstable market place with insufficient places.

- It is a costly, resource intensive and inefficient approach.

- Unplanned moves are inconsistent with child centred care, short placements break the relationships that are the most therapeutic factor for all children.

The alternative is not just a theoretical model. There are a small number of examples working in practice, with the cross-regional project centred on a sub-region around Buckinghamshire being a clear example of success.

Léonie Cowen is a solicitor and Andrew Rome is director of Revolution Consulting