Analysis of administrative data from nearly half a million households across 14 London boroughs shows how the economic fallout from COVID has impacted the caseloads and costs of council tax support schemes in the capital.

Council tax liability rose by 4% on average across London last April and again, by a further 4%, in 2021-22.

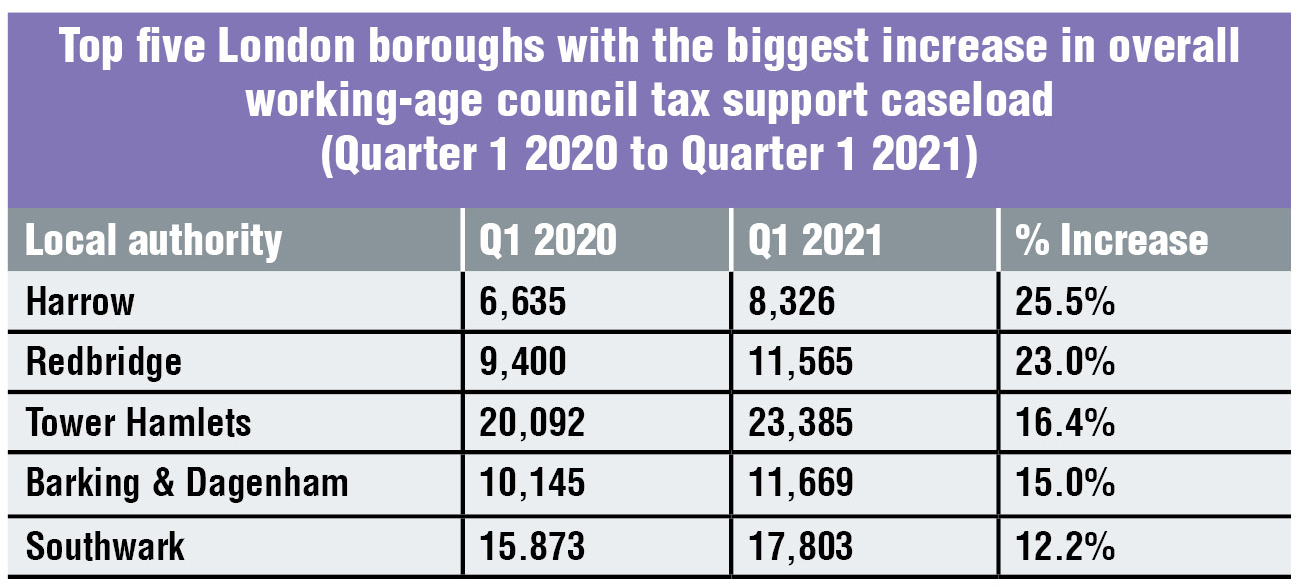

Councils struggling to meet their statutory spending commitments may not be able to maintain the generosity of their council tax support (CTS) schemes if caseloads remain high. At the same time, more people are now in need of council tax support, yet a doubling of Universal Credit claims has only led to an increase in council tax support claims of around 13%. On average, this is an extra 1,942 households claiming support from their council in each borough.

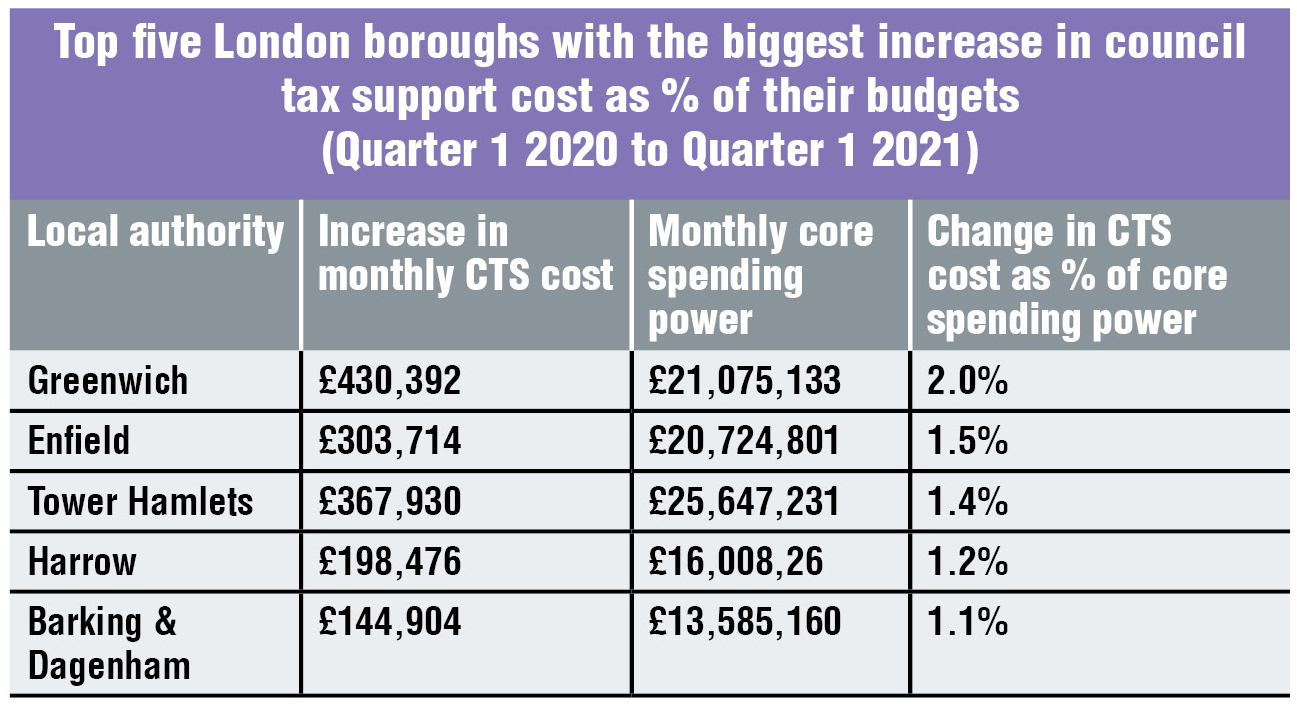

Council tax support costs grew by 16%. This equates to £2.4m for the average borough, representing nearly 1% of a council's total budget.

The take-up rate of council tax support varies widely between boroughs, from 35% of all Universal Credit claimants in Sutton to 14% in Lambeth. This is driven by the generosity of council tax support, awareness and how easy it is to claim.

The Government set up a Hardship Fund for councils as part of its response to the pandemic, allowing them to reduce council tax bills by £150 for those in receipt of CTS.

In 2021-22 the Government is also providing an extra £670m in funding for council tax support in England worth £3.4m on average to the London boroughs in this study.

Despite the growing costs of council tax support, councils are reluctant to impose greater hardship on residents who are struggling to pay their council tax bills. The additional funding will help councils to meet costs in 2021-22, but it is unclear how councils will cover increasing costs once pandemic-related support comes to an end in April 2022.

A growing number of councils are making the case for more generous CTS to help low-income households avoid further hardship and to reduce the impact of trying to collect arrears from people unable to pay. As furlough comes to an end it is very likely that more people will move on to Universal Credit.

Many councils are trying to increase take-up by making CTS easier to claim while making their scheme affordable by reducing administration costs within their council tax support scheme.

Trust for London is backing a project with three London councils to explore how to increase the take-up of CTS, and how to fully automate claims administration using Universal Credit data. Haringey, Camden and Enfield are exploring this by:

- Identifying people likely to be eligible for support, such as those in council tax arrears, those new to Universal Credit.

- Requesting Universal Credit data on these households from the Department for Work and Pensions to carry out an automated assessment.

- Exploring data, scheme design and behavioural barriers to claiming, and to full automation.

The aim of the project is to help councils focused on poverty prevention and upstream activity rather than crisis management and to administer support cost-effectively.

Ultimately, it aims to use Universal Credit data, already shared with local authorities, to deliver on the original vision of a single claims process with CTR administration effectively integrated into a Universal Credit claim.

The latest analysis from Policy in Practice's Low-Income Londoners project was made possible thanks to the pooling of administrative datasets from 14 London boroughs and the ongoing support of Trust for London.

The analysis compares data from each borough from before the pandemic in early 2020 to the first three months of 2021, depending on data availability.

The full analysis and the interactive dashboard of London's changing living standards is available at: policyinpractice.co.uk

Deven Ghelani is director of Policy in Practice